Green Economy and Artificial Intelligence Contributed to the Record High

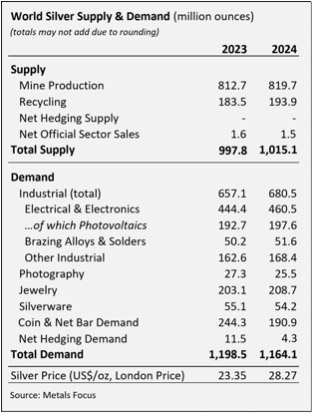

(New York City – April 16, 2025) Silver industrial demand rose 4 percent in 2024 to 680.5 million ounces (Moz), reaching a new record high for the fourth consecutive year. Demand continued to benefit from structural gains linked to the green economy, including investment in grid infrastructure, vehicle electrification, and photovoltaic (PV) applications. Demand was further boosted by end-uses related to artificial intelligence (AI), which drove growth in consumer electronics shipments.

Overall, global silver demand exceeded silver supply for the fourth consecutive year, resulting in a structural market deficit of 148.9 Moz in 2024. Notably, during 2021-2024, the combined deficit reached 678 Moz, equivalent to 10 months of global mine supply in 2024.

These and other key aspects of the 2024 silver market are examined in the World Silver Survey 2025, released today by the Silver Institute. The 88-page Survey also provides an outlook for the silver market in 2025. The Survey was researched and produced for the Silver Institute by Metals Focus, the London-based independent, precious metals consultancy.

Key findings include:

Silver Demand

Total silver demand fell by 3 percent to 1.16 billion ounces (Boz) in 2024. The decline was primarily driven by weakness in physical investment and slightly lower silverware and photographic demand. The drop was partially offset by the continued strength of industrial demand, which enjoyed another record year. In keeping with 2023, growth was underpinned by record electronics & electrical demand. This reflected structural gains in the green economy flowing through from the PV and automotive sectors and grid infrastructure development. Demand also received a boost from AI-related applications. While thrifting and substitution remained limited across most sectors, notable advancements within the PV segment led to a sharp reduction in silver loadings.

On a regional breakdown, China accounted for the largest share of industrial gains, with a 7 percent rise, while India recorded a 4 percent increase. In contrast, Europe saw weaker demand across most countries in the region (except for one-off gains in the UK), while US demand declined by 6 percent in 2024.

Demand for brazing alloys rose by 3 percent, supported by growth in key industries, such as automotive and aerospace. Meanwhile, demand in the ‘other industrial’ category rose by 4 percent, despite a slight drop in ethylene oxide (EO) demand.

Silver jewelry fabrication grew by 3 percent to 208.7 Moz. India accounted for the bulk of these gains, thanks to such factors as the import duty cut, a healthy rural economy, and the ongoing rise in purities. Improving exports to key Western countries also lifted fabrication in Thailand by 13 percent. Western consumption was broadly steady as positives, such as branded silver’s gains, balanced negatives including cost-of-living issues. By contrast, China saw a third consecutive year of losses amid a challenging economic backdrop.

Silverwaredemand declined by 2 percent to a three-year low of 54.2 Moz. The drop was driven by softer demand in India, where elevated prices weighed on the gifting segment.

Coin and net bar demand fell 22 percent in 2024 to a five-year low of 190.9 Moz, led by double-digit declines across all major Western markets. The steepest drop was seen in the US (-46%), due to profit-taking at higher prices, market saturation, and investors’ reaction to Trump’s election. In Germany, the lingering effects of the 2023 VAT hike on certain silver products continued to weigh on demand. In contrast, India stood out with a 21 percent surge, thanks to bullish price expectations and the import duty cut.

Silver Supply

Global silver mine production rose by 0.9 percent to 819.7 Moz, underpinned by increased output from lead/zinc mines in Australia and the recovery of supply from Mexico, as Newmont’s Peñasquito mine returned to full production. This was supplemented by additional growth from Bolivia and the US. Lower output from Chile, down 8.8 Moz y/y, partially offset this growth.

Silver production from lead/zinc mines remained the dominant source of silver, but output was flat y/y. In contrast, silver production from gold mines recorded the strongest growth, up 12% y/y to 13.9 Moz, a three-year high.

Last year, Mexico remained the leading silver mine-producing country, followed by China, Peru, Bolivia, and Chile.

Recycling rose 6 percent in 2024, reaching a 12-year high of 193.9 Moz. Industrial scrap saw the most significant increase in weight terms, mainly led by the processing of spent EO catalysts. In percentage terms, the highest gain came from silverware recycling, which climbed by 11 percent as firmer silver prices and cost-of-living issues encouraged selling in Western markets.

Outlook for Silver in 2025

Total demand this year is forecast to fall marginally to 1.15 Boz. Following a series of all-time records in recent years, industrial fabrication will remain flat in 2025, as the gains in silver’s use in PV offtake ease. Both jewelry and silverware are expected to weaken, but a modest recovery in coin and bar demand in some Western markets should largely mitigate losses.

Total silver supply is projected to increase by 1.5 percent, led by higher mine production. As a result, the silver market is anticipated to remain in a deficit, but this gap will be a four-year low of 117.6 Moz.

As outlined in World Silver Survey 2025, the impact of US tariffs will be a key risk to silver demand this year. An extended period of elevated tariffs, or a further escalation of global trade wars, could lead to significant supply chain disruptions and sharply lower global GDP growth. These will weigh on industrial, jewelry, and silverware demand, though physical investment could benefit from rising safe-haven purchases.

Silver Price

The average silver price jumped by 21 percent in 2024. The start of 2025 saw further gains, with silver exceeding $34 by mid-March amid rising uncertainties surrounding US trade and foreign policy. Thereafter, the silver price has weakened, following the US tariff announcements. Even so, as of April 7, the silver price was still up four percent for this year-to-date.

# # #

About the World Silver Survey and Ordering Information

The Silver Institute has published this annual report on the global silver market since 1990 to bring reliable supply and demand statistics to market participants and the public. Metals Focus independently researched and produced the 35th edition of World Silver Survey. The report was sponsored by 22 companies from North and South America, Asia, and Europe.

A complimentary PDF version of World Silver Survey 2025 can be downloaded from the Institute’s website at www.silverinstitute.org. In North America, hard copies may be purchased from the Institute’s website; for copies outside North America, please contact Metals Focus at www.metalsfocus.com. In addition, members of the media and government officials can request complimentary hard copies of the Survey directly from the Silver Institute.

Contacts:

Michael DiRienzo

Silver Institute

+1-202-495-4030

mdirienzo@silverinstitute.org

Philip Newman

Metals Focus

+44-203-301-6510

philip.newman@metalsfocus.com

Recent Comments